GV Lawyers would like to introduce an article by Lawyer Do Duc Anh and Paralegal Phan My Hanh titled “Affixing price: how to be legal and avoid damage?“ published on Saigon Economic Times 38-2020 (1,553) dated 17 September 2020.

***

Valuation of goods and services is the right of the enterprise. This is always true in terms of business. But affixing prices is a legal story. Failure to grasp the regulations on price affixing can lead to huge damage to the enterprise.

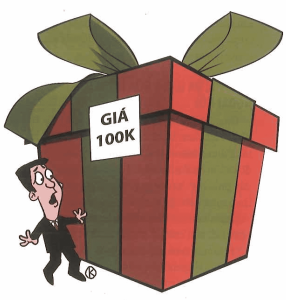

100k is not VND 100,000!

The current business habit is that enterprises often affix prices in the form of “100K” instead of “VND 100,000” for brevity. But 100K is not 100,000 VND! Therefore, writing “100K” on the price list can be considered “unclear price affixing” that leaves customers confused” under Clause 1, Clause 2, Article 12 of Decree 109/2013 / ND-CP. Consequently, enterprises may be subject to a fine of between 500,000 and VND 3,000,000 depending on the case.

Affixing in foreign currency may result in many legal risks

Affixing in foreign currency may result in many legal risks

Another practice is to affix prices in foreign currency. The main goal of the price affixing in foreign currency is to preserve the value of goods, especially for imports when the enterprise has to pay for imports in foreign currency. However, according to the Foreign Exchange Ordinance, the affixing of goods in foreign currency violates the principle of restricting the use of foreign exchange in the territory of Vietnam.

In terms of administrative liability, parties will be warned against the amount of the payment in foreign currency less than 1,000 USD (or another foreign currency of equivalent value). However, when the violating amount is over 1,000 USD (or another foreign currency of equivalent value), the violating parties can be fined 60 – VND 100 million. But the damage doesn’t end there. If the parties have made payments for goods and services in foreign currencies, that foreign currency will be seized and confiscated.

Regarding partner liability, in case the two parties have signed a contract in foreign currency, that contract may be invalidated by the court. At that time, the party receiving the payment in foreign currency must return the received amount and take back the goods they sold to the partner. But if the goods are already used by the buyer, the value of the goods is reduced and it will be difficult to sell the used goods again. Thus, from a small mistake of affixing goods in foreign currency, the enterprise may suffer tricks played by its partner requesting the court to declare the contract invalid in order to recover the paid amount and return the goods when having enough of them after a period of using! Of course, not all partners take advantage of the enterprise’s mistakes to make profit therefrom, but when it is legally wrong, the damage is completely likely.

To reduce the risk of price affixing

In the territory of Vietnam, using foreign currencies and affixing prices in foreign currencies are generally in violation of the Foreign Exchange Ordinance. But it must also be recognized that preserving the value of any import is a reasonable need of the enterprise. Therefore, to meet this demand, enterprises often agree to adjust prices according to the change in exchange rate between VND and foreign currencies (e.g US dollar, Euro, etc). However, some regulators also take the view that, even if the parties agree to adjust the selling price according to the exchange rate change, such a pricing will still be considered a pricing in foreign currency. Therefore, the solution often used by enterprises, especially in long-term contracts, is the agreement to adjust the price of goods according to the consumer price index (CPI) or inflation.