Dear Valued Customers and Partners,

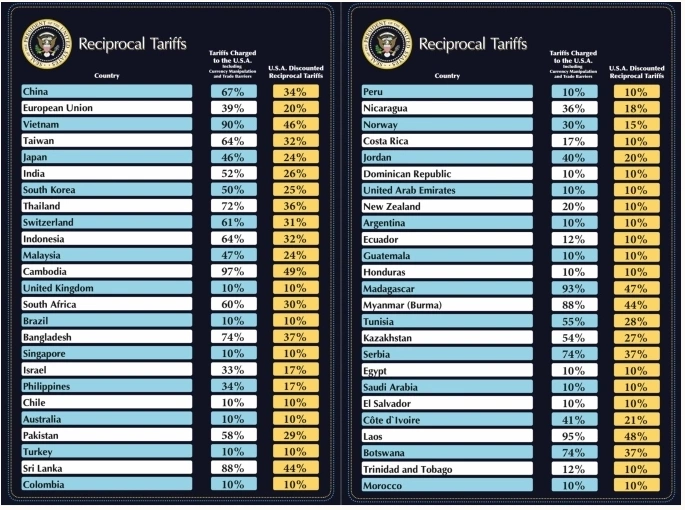

In the early morning of April 3, 2025 (Vietnam time), US President Donald Trump announced a new import tax policy on more than 180 economies, with Vietnam being among the top countries subject to the highest countervailing tax of up to 46%.

Accordingly, from April 5, 2025, the basic tax rate applied to all goods imported into the US is 10%. Then, from April 9, 2025, a higher countervailing tax will be applied to more than 60 countries that the US designates as “causing trade imbalances,” including China (34%) and Vietnam (46%).

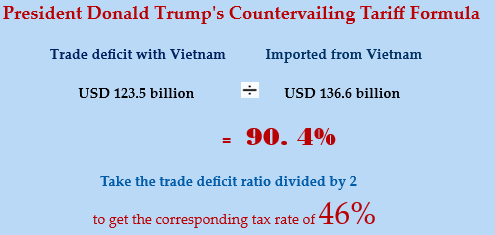

The tax calculation formula is based on the trade deficit of the relevant countries in their trade relations with the US. It seems that the US uses the formula: Tariff = Bilateral Trade Deficit / Total Import Value from that country. For Vietnam, the trade deficit is $123.5 billion (exports $136.6 billion, imports $13.1 billion), the deficit ratio compared to total trade turnover is about 90%, and the US Government takes 50% (90% / 2 = 45%, rounded up to 46%) to apply. This 50% rate is referred to by President Trump as a “friendly and reciprocal” tax, demonstrating a flexible approach and paving the way for bilateral negotiations with countries.

However, the countervailing tax does not apply to certain items, including copper, pharmaceuticals, semiconductors, lumber, gold, energy, and some minerals not available in the US. Vietnamese associations and experts believe that the 46% tax that the US applies to Vietnam is an additional countervailing tax based on the basic 10% tax for all imports. This tax targets strategic items (such as textiles, footwear, furniture) or industries under anti-dumping/subsidy investigations (AD/CVD), reducing the competitiveness of Vietnamese goods in the US, while forcing Vietnam to adjust its trade balance.

The high countervailing tax imposed by the US on Vietnamese goods has caused many Vietnamese businesses to be confused and worried. When this tax is applied, not only can Vietnamese goods exported to the US be greatly affected, but it can also impact foreign investment flows in the near future.

GV Lawyers accompanies and shares with businesses, especially those affected by the US countervailing tax policy. Businesses should stay calm and proactively find solutions, while cooperating with Government agencies in seeking effective solutions.